2.96%

Earn Dividends AND Enjoy All the Benefits!

![]()

No Monthly Fees or Minimum Balance

![]()

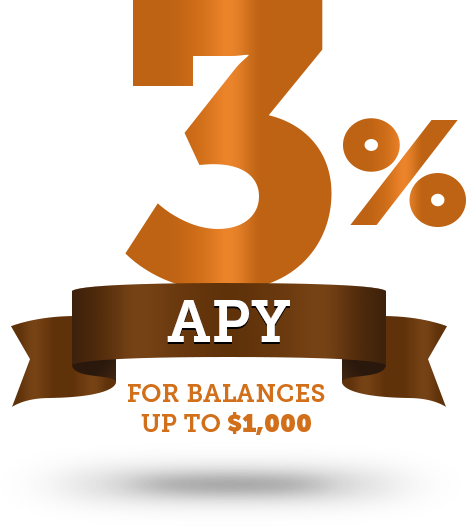

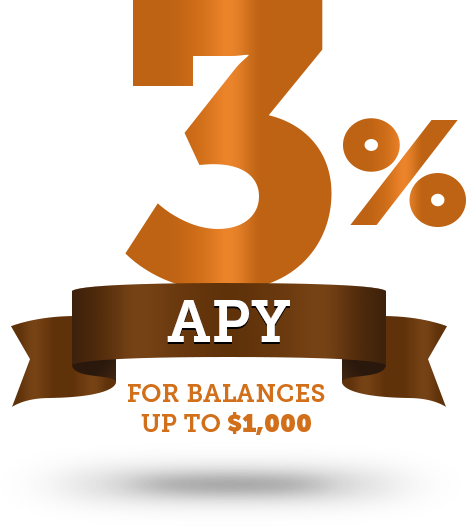

Competitive APY* on Balances

![]()

Free Online Banking and Bill Pay

Ready to earn 3.00% APY with Affinity FREE Checking?*

Current members:

Not a member yet?

Credit Union FREE Checking Account Features

- Free checking account

- No monthly maintenance fee

- No minimum balance requirement

- Free access to Online Banking and the Mobile App

- Free Mobile and Online Bill Pay

- Free Mobile Deposit of checks

- Free eStatements

- Free ACU Visa® debit card

- Personalized Debit Cards

- Unlimited monthly transactions

- Access to a nationwide network of over 35,000 surcharge-free ATMs

- Earn 3.00% APY on balances up to $1,000, 0.75% APY up to $15,000, and 0.50% APY on higher balances

Current members:

Not a member yet?

|

3.00% APY on Balances up to $1,000Hey, South Sound, make sure your everyday cash works as hard as you do! Earn 3.00% APY* on balances from $0-$1,000 while keeping your money available for everyday expenses. |

Online and Mobile Banking ServicesAffinity FREE Checking makes it easy to manage your finances at home or on the go. You can check your account balance, transfer funds, and deposit checks quickly and securely from your phone, computer, or another device. Note: All card controls and alerts are now integrated into our single Mobile Banking app for a streamlined experience. |

Customized Debit CardYour free checking account comes with an option to order a personalized debit card online. Alternatively, you can choose from the selection of great designs that ACU offers with our instant-issue debit cards. |

Affinity FREE Checking Account Rates

Rate as of: 04/08/2023

Affinity FREE Checking Account

Up – $1,000

3.00%

Affinity FREE Checking Account

$1,000.01 – $15,000

0.75%

0.75%

Affinity FREE Checking Account

$15,000.01+

0.50%

0.50%

Click below to see our full list of interest rates and any applicable fees.

Three Simple Steps to Open a Free Checking Account

Step1 |

Become a Member of ACU Credit UnionOur membership is open to just about everyone. See our membership eligibility and confirm you can join us. |

Step2 |

Open a Regular Share Savings AccountUnlock all our quality products and services when you open a savings account with a deposit of just $25. |

Step3 |

Select Affinity FREE Checking AccountSelect our free checking account option and earn generous dividends AND all our convenient benefits and features! |

Current members:

Not a member yet?

★★★★★

“I made the best banking decision by joining ACU. I have always received excellent service, and the staff is outstanding.”

-Kathleen H., DuPont, WA

Affinity FREE Checking Account FAQs

-

What features are free with your Affinity FREE checking account?

-

With our Affinity Free checking account, you automatically qualify for these free features:

- Free online and mobile banking

- Free bill pay

- Free mobile deposit

- Free eStatements

- Free debit card

- Free ATM withdrawals from ACU and Co-op ATM network machines

-

Can I earn interest on a free checking account?

-

Yes, one of the many great features of our Affinity FREE Checking Account is that you can earn a competitive rate on your balance, especially if it’s under $1,000. To earn dividends, you must have a direct deposit of at least $500 per month, 10 point-of-sale transactions, $15,000 in combined loans and/or deposits, and enroll in E-Statements.

-

What fees do I need to pay on a free checking account?

-

A free credit union checking account is designed to keep costs as low as possible. Unlike some other financial institutions, we offer checking accounts with:

- No monthly fee

- No minimum balance

- No low-balance fee

Also, you can avoid overdraft fees by linking your checking account to another account, such as your Share Savings Account or a Money Market Account. Other fees may apply.

-

Do credit unions charge for checking accounts?

-

Many credit unions do charge their members directly or indirectly for checking accounts. For example, you may be charged a monthly or annual fee to maintain a checking or savings account, or you might face a fee if you do not maintain a minimum account balance.

At ACU, our Affinity Free checking account is genuinely free with no minimum opening balance, no monthly service fee, and no required minimum balance. At ACU, when we say free, we mean really free.

-

Can you open a credit union account online?

-

Yes, many credit unions do allow you to open accounts online, provided you meet membership eligibility requirements. At ACU, we serve the South Puget Sound community by allowing members to open savings, checking, and share certificate accounts online.

-

Who is eligible to open an Affinity FREE Checking Account?

-

You need to be an ACU member to open an Affinity FREE Checking Account. ACU membership is open to:

- Anyone who lives, works, or worships in the Pacific Northwest

- Members of the armed forces (active, retired, or reservist) and civilian personnel, or relatives of these members

- Members of the Association of the United States Army (AUSA)

- Employees of America’s Credit Union and their relatives

More ACU Checking and Saving Options

A free checking account offers all the essentials, but what if you want more? ACU offers two other checking accounts to meet your unique needs, while our savings account unlocks all our financial products and services.

Earn dividends on amounts above $1,000 and enjoy cell phone insurance, identity theft coverage, and 10¢ back on debit card purchases over $5. Learn More

Enjoy competitive rates on higher balances with no monthly fee, free checks, and identity protection. Learn More

Open a share savings account and start earning dividends with unlimited deposits to build a secure future. Easily transfer and withdraw funds when needed. Learn More

*APY = Annual Percentage Yield accurate as of 02/01/2023. Limited to one Affinity FREE Checking account per primary account holder. Fees may reduce earnings. Rates are subject to change. See Fee Schedule. 3.00% APY applies to balances up to $1,000.00. Balances $1,000.01 to $15,000.00 earn 0.75% APY. Balances over $15,000.01 earn 0.50% APY. Regular Share Savings with a minimum deposit of $25 is required. To earn dividends, you must have a direct deposit of at least $500 per month, 10 POS transactions, $15,000.00 in combined loans and/or deposits, and enroll in E-Statements. The qualification cycle is not the same as your monthly statement cycle. The Qualification Cycle is defined as the first calendar day of the month through the last calendar day of the month (example: March 1–March 31). Transactions may take one or more banking days from the date the transaction was made to post to and settle in the account. ATM-processed withdrawals do not count as qualifying debit card transactions.