![]()

No Minimum Deposit or Monthly Service Fees

![]()

Competitive Rates on Balances Over $5,000

![]()

Identity Theft Coverage and Free Box of Checks

Already an ACU member? Want a checking account that pays greater APY* on large balances?

New to ACU and ready to enjoy the benefits of joining a credit union?

Affinity Premier Account Features

- No monthly fee or minimum deposit to maintain

- Market rate dividends paid on balances $5,000 or greater with direct deposit

- Tiered interest rates on different balances

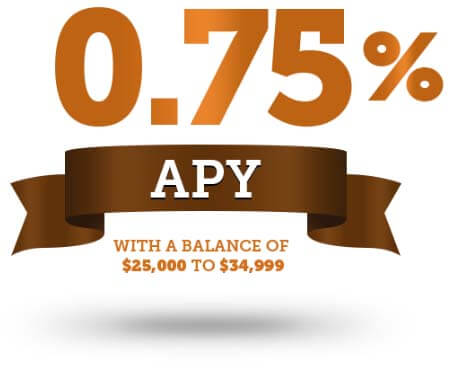

- Earn highest rates of 0.75% APY* with a balance of $25,000 to $34,999

- Identity theft coverage

- Free box of checks annually

- Free ACU Visa® debit card

- Unlimited debit card purchases

- Access to a nationwide network of over 35,000 free ATMs

- Online Banking and Mobile App with Mobile Deposit and Billpay

Identity Theft ProtectionA robust security system is essential now that so much of your financial activity takes place online. We want to protect your personal identity as well as your assets and credit scores. When you choose Affinity Premier checking, you gain peace of mind knowing you have access to:

|

Online and Mobile Banking ServicesAffinity Premier checking makes it easy to manage your finances at home or on the go. You can check your account balance, transfer funds, and deposit checks quickly and securely from your phone, computer, or another device. |

Customized Debit CardYour free checking account comes with an option to get creative and order a personalized debit card online. Alternatively, you can enjoy the great designs that ACU offers with our instant-issue debit cards. |

ACU Card AppOur free app gives you complete control over your ACU Visa debit or credit card. It works with iPhone, Android, and most other mobile phones. Download the app to set up Transaction Alerts, Card Controls, Seamless Travel, and Visa Checkout. |

Click below to see our full list of interest rates and any applicable fees below.

How To Open a No Monthly Fee Checking Account

Step1 |

Become a Member of ACUYou can join ACU if you live, work, worship, or attend school in the Pacific Northwest or meet other criteria. |

Step2 |

Open a Regular Share Savings AccountUnlock all our quality products and services when you open a savings account with a deposit of just $25. |

Step3 |

Select Affinity Premier Checking AccountDeposit any amount of funds, then start earning competitive dividends when your balance reaches $5,000. |

★★★★★

“I can’t say enough good things about ACU!! I am always helped when I need it, and I appreciate everyone that goes out of their way to help!”

Hailey D.

FAQ About Our Affinity Premier Checking Account

-

How can I earn interest on your checking account with no minimum deposit?

-

Our Affinity Premier Checking offers a wide range of features that you can access automatically after account opening, no matter your balance.

To earn interest and dividends, you need to set up a direct deposit into your account and have a balance of at least $5,000. Here’s what you can earn with our no monthly fee checking account:

- 0.25% on balances of $5,000 to $14,999.99

- 0.50% on balances of $15,000 to $24,999.99

- 0.75% on balances of $25,000 to $34,999.99

- 0.01% balances over $35,000

-

What Online and Mobile Banking features are available?

-

All our checking accounts offer these free digital services:

- Online and Mobile Banking

- Bill Pay

- Mobile Deposit

- eStatements

-

What fees do I need to pay on a no minimum deposit checking account?

-

While you need a balance of at least $5,000 to earn interest, there are no minimum balance requirements to access the other features of our Affinity Premier Checking:

- No monthly maintenance fee

- No service fee

- No low-balance fee

- No ATM fee on ACU ATMs and the Co-op Network ATMs

In addition, you can avoid overdraft fees and enjoy overdraft protection by linking your checking account to another banking account such as your Share Savings Account or a Money Market Account. We’ll automatically transfer money to cover your checks and payments.

-

Can I open a checking account if I need to repair my credit?

-

You may not qualify for an Affinity Premier checking account if your finances aren’t in great shape, but ACU offers an Opportunity Checking Account so you can get your financial health back on track.

The monthly fee is just $8.95 when you set up a direct deposit to receive your entire payroll, pension, or Social Security check with a minimum of $500 per month.

More Quality ACU Checking and Saving Options

Our range of Affinity checking accounts are designed to suit different needs and wants, including Affinity Basic and Affinity Plus. You can gain access to all our products and services once you open a Regular Share Savings.

Relax knowing you have cell phone insurance, identity theft coverage, and ATM refunds plus 10c back on purchases over $5.Learn More

Earn a great rate on balances under $1,000 and get all the essentials like Online and Mobile Banking.Learn More

Open a share savings account and start earning dividends with unlimited deposits and easy transfers and withdrawals.Learn More

* APY= Annual Percentage Yield accurate as of 02/01/2023. Limited to one Affinity Premier Checking account per primary account holder. Only consumer accounts in good standing are eligible. Rates are subject to change. Fees may reduce earnings on the account. Balances $35,000.00+ earn the Regular Share Rate. To earn dividends, you must have direct deposit of at least $500 or more per month. If qualifications are not met, all balances earn 0.00% APY. Balances $5,000.00 to $14,999.99 earn 0.25% APY. Balances $15,000.00 to $24,999.99 earn 0.50% APY. Balances $25,000.00 to $34,999.99 earn 0.75% APY. Regular Share Savings with a minimum deposit of $25 is required. Accounts that do not satisfy the requirements of the account will still receive the identity theft insurance. Identity theft expense reimbursement insurance is underwritten by Lyndon Southern Insurance Company, a member of the Fortegra family of companies.